Securitize announced joining the IBM Blockchain Accelerator program to modernise the $82 trillion corporate debt market using blockchain technology. The article IBM to modernise the issuance of corporate debt using blockchain technology from Securitize was first published on Security Token Network.

Tag: STO

Securitize Chosen to Join IBM’s ‘Blockchain Accelerator Program’ to Tokenize the $82T Corporate Debt Market

Securitize, the leading platform for compliant security token issuances, has been selected to join IBM’s Blockchain Accelerator Program. The platform was chosen to tackle the $82 trillion corporate debt market with the help of blockchain technology. Securitize is a major player in the emerging security token space. Boasting major investments from Ripple and Coinbase, the […]

Swarm Plans to Tokenize Assets for Free, Introduces Staking Model for Issuers

Swarm, a non-profit which specializes in providing infrastructure necessary for digital securities, has just announced that it will be hosting no-fee issuances of security tokens. These same issuers will also benefit from a staking model which will reward holders over time. Swarm has been positioning itself as one of the leaders in making security token […]

CEO of Atomic Capital: “Digital Custody for Securities Is Bogus”

Alexander S. Blum, CEO of Atomic Capital, recently published a piece on why digital custody for securities as it exists today is actually a bloated, overly-expensive obstacle for the cryptocurrency space. Custodial concerns for cryptocurrencies have always been a pressing concern. After all, how will institutional players be able to securely store their digital assets […]

Krypital Group and OpenFinance Network Align to Advance Security Token Ecosystem

Krypital Group and Open Finance Network form Partnership Krypital Group has recently announced the creation of a working relationship with OpenFinance Network. In doing so, each company became more well-rounded, as they can now offer a more complete suite of services to their clientele. Often serving as an incubator, Krypital Group now gains the ability […]

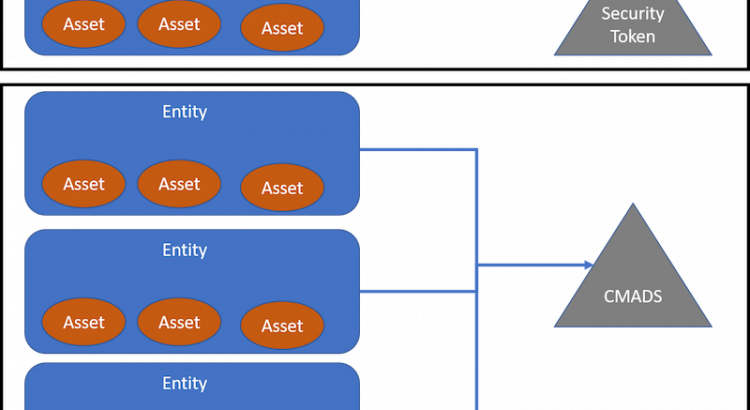

Collateralized Multi-Asset Security Tokens: What’s It All About?

Analyst Jesus Rodriguez came out with another piece recently discussing what he calls “collateralized multi-asset security tokens.” The idea behind them is they would be dynamic crypto-securities similar to current collateralized debt obligations (CDOs) but much more transparent. Jesus Rodriguez has been a long-time commentator on the tokenized security market and its developments. He’s written, […]

Aspencoin Transitions to Securitize After Raising $18 Million in Security Token Offering

As of January 16th 2019, Aspencoin— the digital security linked to a luxury resort in Colorado— is officially transitioning to the Securitize. The news has come after a successful and SEC-compliant funding round for Aspencoin, which had an $18 million valuation. Aspencoin’s Switch to Securitize Explained Aspencoin represents fractional equity ownership of the luxury St. […]

Soon to Launch Belarusian Exchange said to Support Digital Securities

New Exchange Launched It was recently announced that a new exchange, which supports the trading of digital securities, is launching within Belarus. The launch of the exchange was met with a flurry of excitement, as thousands of traders submitted applications within hours of it opening. Viktor Prokopenya spoke with Reuters on the launch, stating, “This […]

BANKEX Partners with Digital Trust Fund, Bringing Security Tokens to Uzbekistan’s Digital Economy for the First Time

BANKEX, a global fintech firm, has announced that it will be working closely with Digital Trust Fund to support and develop Uzbekistan’s digital economy. Digital Trust Fund is a foundation which promotes tokenized assets in Uzbekistan, the first of its kind in the Central Asian country. The global market of tokenized securities will need representatives […]

CEZEX to Enter the Asian Market in a Major Way

The Philippines Cagayan Economic Zone Authority (CEZA) announced plans to expand their operation into the Hong Kong market in the first quarter of 2020 via the launch of the county’s first licensed security token exchange – CEZEX. Asian investors welcomed the news with praise. Many investors in the region seek a more secure crypto investment […]