Analyst Jesus Rodriguez came out with another piece recently discussing what he calls “collateralized multi-asset security tokens.” The idea behind them is they would be dynamic crypto-securities similar to current collateralized debt obligations (CDOs) but much more transparent.

Jesus Rodriguez has been a long-time commentator on the tokenized security market and its developments. He’s written, for example, on the current issue regarding information asymmetry between issuers and investors in the token security space. He’s also controversially claimed that most security token projects currently live will go bust due to non-sustainable funding models. Now, he’s come out with a new piece posted on his LinkedIn where he discusses a concept he believes could potentially play a large part in the security token industry: collateralized multi-asset digital securities (CMADS).

CMADS: What Are They?

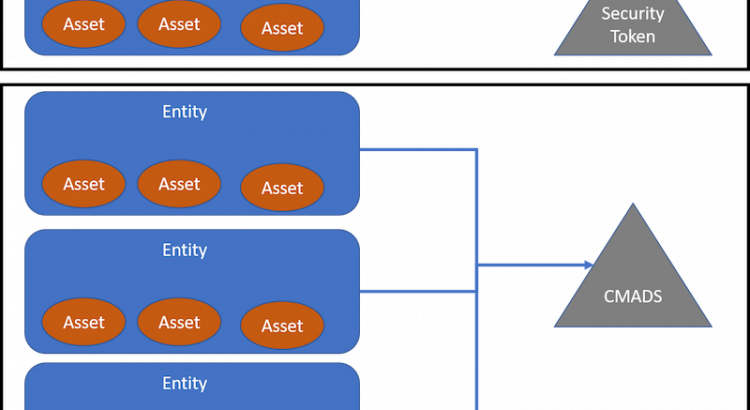

“The traditional model for security tokens typically generates a crypto-security correlated with assets owned by a specific entity,” Rodriguez writes. However, what if the underlying assets were moved and rearranged dynamically thereby influencing the price of the overarching security? This is the concept Rodriguez is posting with CMADS.

The difference between CMADS and regular single-asset tokenized securities respectively would be the following then:

- Many issuing entities as opposed to one.

- A dynamic number of assets over time as opposed to a static one.

- Valuation is inferred and fluctuating as opposed to calculated during issuance.

- The goal of CMADS would be lending, borrowing, and commerce whereas single-asset security tokens would be fundraising, digitizing assets.

Interestingly, Rodriguez also seems to be of the opinion that CMADS as a financial instrument would also be more liquid since the underlying assets would be ever-changing. Much of this dynamism would need to be “baked into” the token standard of the digital security.

Rodriguez outlines more benefits to CMADS in his full article which is worth reading.

What do you think of Rodriguez’s conclusions? Are single-asset digital securities best used for fundraising purposes? Let us know your thoughts in the comments.

Image courtesy of Linkedin.

The post Collateralized Multi-Asset Security Tokens: What’s It All About? appeared first on The Tokenist.