NYCQ BLOCKCHAIN INFRASTRUCTURE FUND

- The NYCQ Blockchain Infrastructure Fund “NYCQ” is managed and advised by professionals with deep industry expertise from firms such as SoftBank Capital, Goldman Sachs, Wells Fargo, and Google.

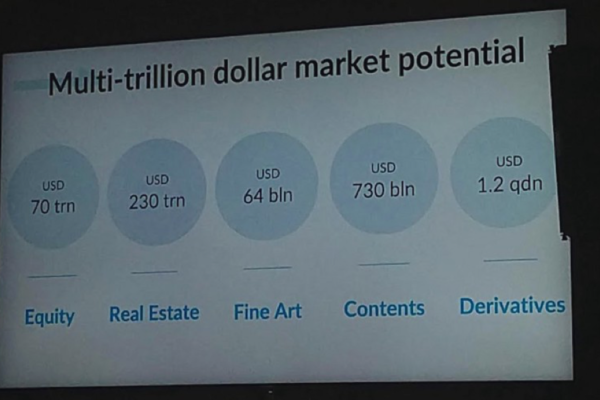

- CityBlock Capital believes that blockchain technology will revolutionize the current financial system. The NYCQ Fund makes equity investments in early stage blockchain infrastructure companies. These companies aim to modernize the current financial system by using blockchain technology to settle trades instantly, eliminate intermediaries and reduce fraud. CityBlock Capital only makes equity investments. We do not invest in cryptocurrency or utility tokens.

- NYCQ is designed to give investors diversified access to blockchain infrastructure investments normally only accessible to institutional investors. The principals of NYCQ have deep relationships with industry leaders in the blockchain ecosystem.

NYCQ intends to invest in a portfolio of companies building digital technology which, we believe, will replace current capital markets infrastructure. We believe assets will move from paper/electronic ownership to digital ownership. We intend to invest in the following types of companies:

Clearing Houses, Depositories, Securities Services Firms, Market Aggregation Tools , Data Analytics Companies, Index Providers, Exchanges, Issuance Platforms

Minimum Individual Investment Size: $50k USD

Minimum Institutional Investment Size: $500k USD

Accepted Currency: USD

First Closing: $1M

Subsequent Closings: Rolling

Target Fund Size: $10M

Fund Type: Closed End Venture Fun

Fund Lockup: 1 Year

Capital Deployment: 2 Years

Fund Duration: 10 Years

Management Fee: 2%

Incentive Allocation: 20%

Medium by cityblock-capital

CityBlock Capital Announces Strategic Investment from Stonegate Digital Capital Group

NEW YORK, Nov. 13, 2018 (GLOBE NEWSWIRE) — CityBlock Capital announces a strategic investment from Stonegate Digital Capital Group, the i...

Nov 13, 2018 / Read More

3 Principles for Building the CityBlock Capital Investor Network

Like any venture firm, we here at CityBlock Capital are aimed at producing exceptional returns for investors — but we’re convinced that d...

Sep 10, 2018 / Read More

Why NYCQ is the Smart Money

We’re excited to highlight a new interview featuring Rob Paone — a.k.a. Crypto Bobby — interviewing Nikhil Kalghatgi and Ateet Ahluwalia....

Aug 13, 2018 / Read More

The Story of CityBlock Capital: Chapter 1

I’m an experienced financier, but when one of my advisers called last year to check my progress on a new fund, I felt like a high schoole...

Jul 09, 2018 / Read More

Introducing $NYCQ — Investing in the Future of Finance

On July 9th, CityBlock Capital opens early access to our first tokenized venture fund, NYCQ. We believe we’re at the start of something v...

Jul 09, 2018 / Read More

CityBlock Capital announces NYCQ, a tokenized venture fund for investment into NYC startups

CityBlock Capital is announcing NYCQ, a tokenized venture fund for investment into top New York City startups. The company will source ca...

May 17, 2018 / Read More