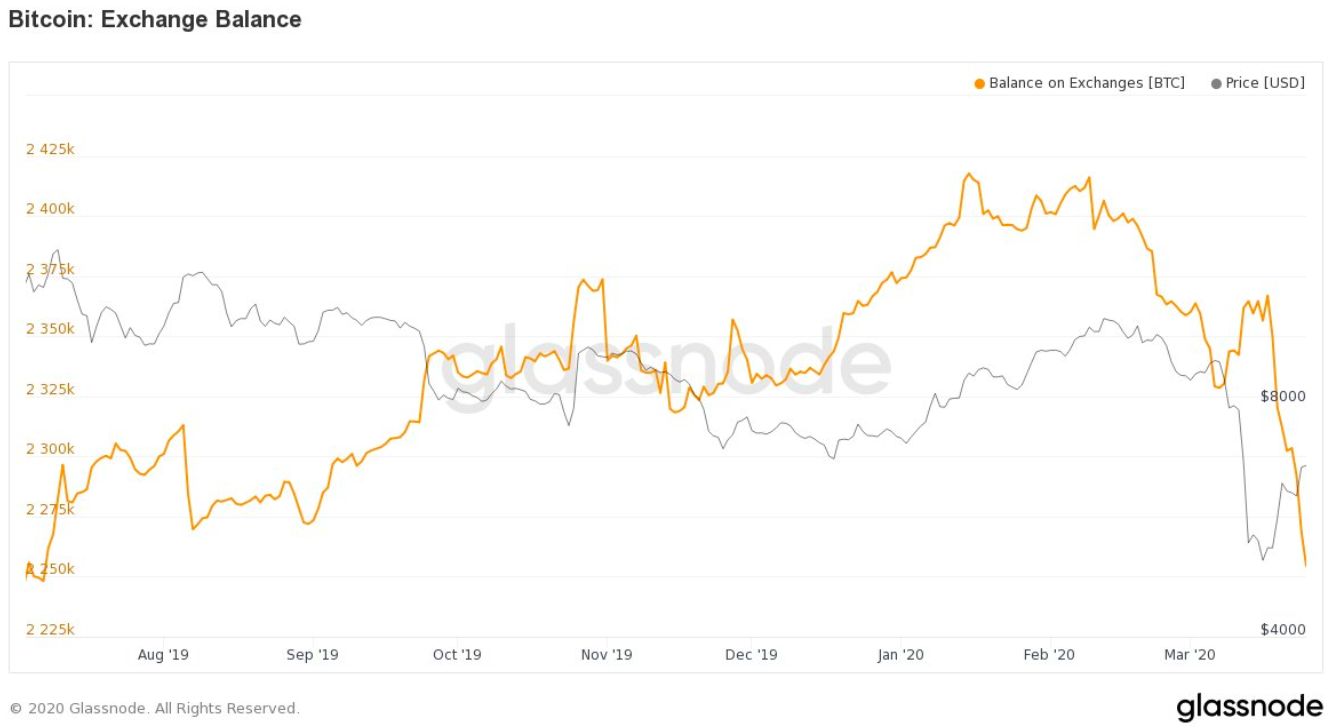

On March 12th, the price of bitcoin went down to $3,850 and altcoins dropped even harder that wiped out about $90 billion from the cryptocurrency market. Since then, the market has added $44 billion as Bitcoin jumps over 60% and takes altcoins up with it. However, investors are still withdrawing their funds from exchanges notwithstanding the price action. Crypto data provider Glassnode, noted,

“Despite the volatility, Bitcoin holders appear to be withdrawing their funds from exchanges. Outflow has been increasing daily since March 18. According to our labels, BTC exchange balances are the lowest they’ve been in ~8 months.”

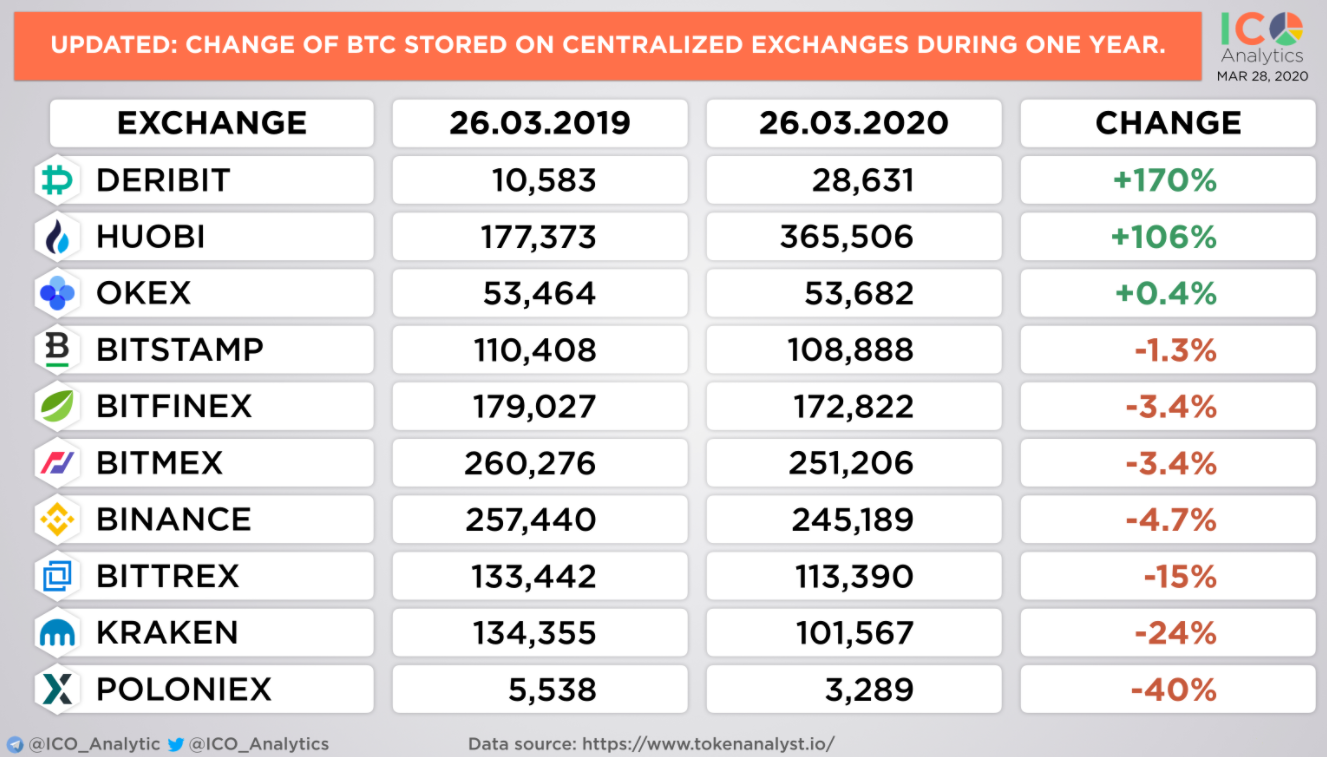

In the past month, only a few of the exchanges like Bittrex, Bitstamp, Bitfinex, and Poloniex saw an increase of as much as 2% in Bitcoin balance. Derivatives platform, Deribit saw the biggest flow out of BTC at 16% followed by 11% in BitMEX, another derivatives platform. Binance recorded the least percent of bitcoin moved out of the exchange this past month, as per ICO Analytics.

When it comes to the past one year, Deribit leads with an increase of a whopping 170% of Bitcoin stored on the centralized exchanges. Deribit is followed by a 106% increment on Huobi and 0.4% on OKEx.

The biggest drop was seen by Poloniex of 40% followed by Kraken’s 24%, and Bittrex’s 15%. Bitstamp, Bitfinex, Binance, and BitMEX’s drop in Bitcoin storage has been between 1 to 5%.

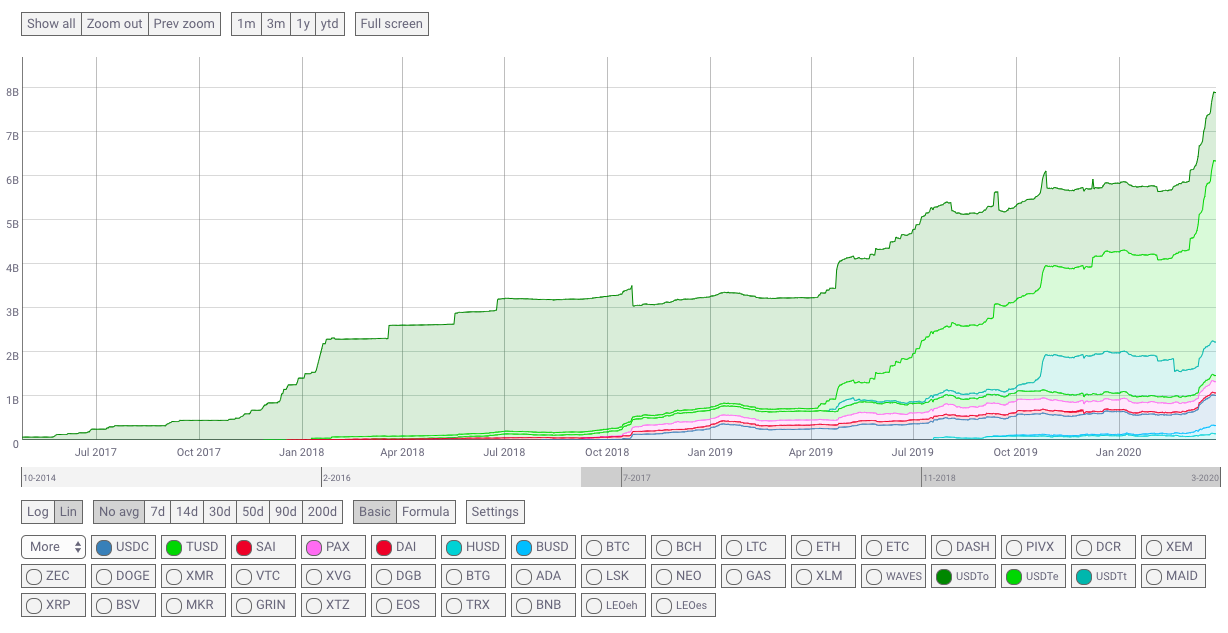

Amidst this, stablecoins have emerged as the winner. While the total market capitalization lost 45% in the week after the record crash, stablecoins’ capitalization keeps on growing.

Binance’s BUSD added a considerable capitalization of more than 100%. According to Changpeng Zhao, founder and CEO of Binance what differentiates BUSD from other stablecoins is that,

“BUSD is approved by NYDFS, peace of mind, Bank deposits audited by top audit firms (as oppose to a blackbox), and high number of pairs, high liquidity, supported by binance and many other exchanges.”

The supply of stablecoins including USDT, USDT-ETH, USDT-ETH, TUSD, DAI, PAX, USDC, BUSD, and HUSD collectively is just shy of reaching $8 billion, as per Coin Metrics.

These fiat-pegged stablecoins that Adamant Capital’s Tuur Demeester calls the “bridges of Bitcoin” are interestingly based on Ethereum and form about 38% of Ether’s market cap.

Commenting on this trend, Nic Carter of Coin Metrics said, “just interesting to watch as dollars become the native currency on chain.”

Ethereum (ETH) Live Price

1 ETH/USD =$133.8179 change ~ 6.93%

Coin Market Cap

24 Hour Volume

24 Hour VWAP

24 Hour Change