Software For Everything

“Software is eating the world” has been the motto of Silicon Valley for decades. And this is rather true, considering how there is no sector of the economy unaffected by digitalization. With the rise of Big Data, Work-From-Home, omnipresent smartphones, and of course AI, this is not changing any time soon.

Software is also a sector that has evolved a lot from the programmer in a garage of the 1970s and 1980s. Now, innovation requires massive resources, from whole datacenters worth tens of billions of dollars to train AI, to access to a massive trove of data to train said AI.

So to find the software companies (and stocks) the most likely to push innovation forward, we should look at either the companies operating in the most advanced fields, or the ones with the resources (technical and financial), data, and commercial position to revolutionize the world once again.

Best 10 Software Stocks for Technological Advancements

Oracle Corporation (ORCL)

Oracle is one of the largest SaaS companies in the world, through its ERP offering (Enterprise Resource Planning) and other associated software covering virtually everything from accounting to project management and supply chain.

It has more than 430,000 customers in 175 countries and $50B+ of expected revenues in 2023.

Oracle is very active with cloud systems, with the bulk of the company revenues still coming from it ($30.2B out of $42.4B in 2022).

The company is very active in the Healthcare sector, especially since its $28B acquisition in 2022 of Cerner, a major provider of EHR (Electronic Health Record – a digital patient file system) and other hospital software for anesthesia, radiology, surgery, etc.

This merging of Cerner and Oracle software provides Oracle with a complete healthcare SaaS offering, potentially integrating together EHR, finances, accounting, image database, and leading ERP Netsuite (with a special version existing for healthcare & life sciences).

The company is also aggressively moving into analytical AI, with automated systems able to forecast the company’s activity, and needs and offer in-depth analysis of efficiency in general.

Source: Oracle

Combined with the sheer amount of data managed by Oracle in every industry, this makes it a prime contender for AI deployment at the enterprise level. And as the recent acquisition of Cerner demonstrates, there is still large space for the company to grow its offer beyond ERP and into other enterprise software services.

Adobe Inc. (ADBE)

Adobe is a leading provider of software and apps for digital workers, especially in creative fields, among which the most famous are Photoshop and Acrobat (PDFs). Other important softwares from Adobe are Illustrator, Lightroom, InDesign, and After Effects.

Source: Adobe

For a long time, Adobe softwares were sold through very pricey licenses you would buy once, and often expense on your company budget, as the price tag made it somewhat inaccessible to amateurs. This also encouraged a flourishing market for “free” pirated versions of the company’s softwares.

In 2013 Adobe pivoted to a subscription-based system, what was at the time a bold move into cloud-only services.

This move paid off, expanding the pool of people learning and using Adobe softwares, while also ultimately extracting more value from its users than buying and selling only irregularly a copy of its products.

Adobe is still growing quickly, with 13% year-to-year growth in Q3 2023

Adobe’s focus on image creation and edition also means that it is at the center of attention with the emergence of generative AI like Mindjourney. Luckily for its shareholders, Adobe is also at the forefront of this revolution in image creation, with its Firefly offer integrated generative AI into Adobe products.

Source: Adobe

The AI can not only generate images from text, but also create from nothing missing parts of an image, turn 3D into images, recolor, and apply texture to text. Essentially making it effortless that which used to take a lot of time using the other tools of Adobe.

The AI is natively integrated into the whole Adobe Software Suite, making its usage much more powerful and seamless for professionals than most of its competition. This has already been downloaded by 3 million users.

Adobe is a company at the center of everything visual on the internet, from image generation to photography to design. Considering its light-speed reactivity to the arrival of generative AI, it is likely to stay the first choice for digital professionals moving forward.

Salesforce, Inc. (CRM)

Salesforce’s core software is one of the world’s most popular CRM (Customer Relationship Management) software. It has offerings for every industry and company size. The company is also behind the popular work chat app Slack, acquired in 2021.

It made $31.4B in 2023, with an 18% year-to-year growth.

Source: Salesforce

One key strength of Salesforce is its extensive integration with virtually every other work-related app, with no less than 2,600 pre-built integrations. It means that Salesforce users can at any time connect their customer and sales data to any other solution without time-consuming and costly integration projects.

Source: Salesforce

The company is leveraging AI to create no-code solutions for managers looking to develop automation without being programmers themselves. It offers through AI a “low-code” bot system that can be easily created with minimal effort and technical knowledge and the integration with Slack and Chat-GPT allows for efficient chatbots.

The company also offers Einstein, an AI tool to increase sales efficiency, help write emails, provides an AI sales assistant, Chat-GPT for services, etc.

Salesforce’s AI solutions are a boost to companies’ team productivity, but also a safe way to deploy AI without risking compromising sensitive data. This should solidify the company’s position in the CRM market, and help it grow its user base even further.

SAP SE (SAP)

Besides Oracle, the other major ERP software is SAP, with 280 million cloud users through 24,000+ companies. Both are competing in the same space but with somewhat different characteristics. While Oracle’s ERP is considered the most “powerful”, it is also more expensive, more complex, and SAP is often considered more secure.

Like many enterprise subscription services, SAP tends to have a very high retention rate of its clients, and to grow over time the relationship, leading to increasing income from existing cohorts.

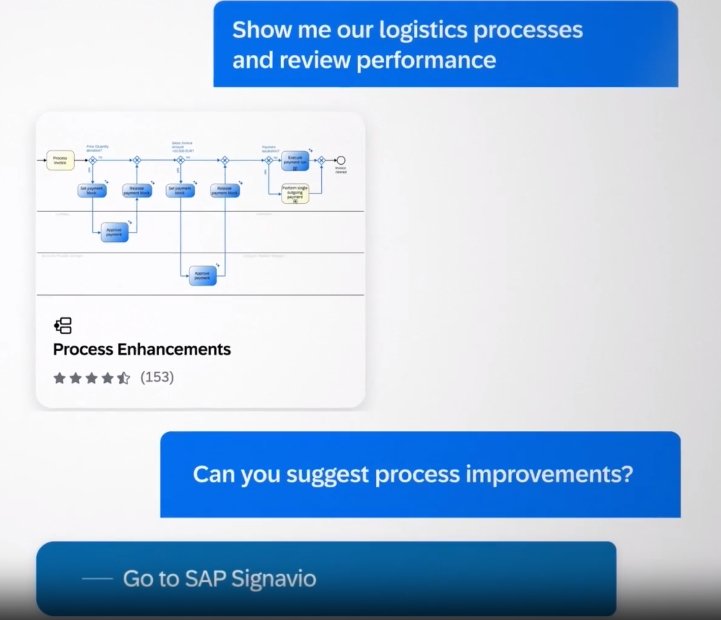

Source: SAP

SAP is not lagging with AI either, thanks to its Joule AI copilot system. It works as a virtual personal assistant, from generating job descriptions in HR to coding assistance.

Source: SAP

AI solutions are also available from SAP in sales, marketing, supply chain, procurement, and HR, all integrated with the other software to create a secure environment where to use generative AI.

It is likely there is space for more than one major player in deploying ERP and AI at scale at the enterprise level, and that makes SAP stock a good complement to Oracle discussed above.

Fiserv, Inc. (FI)

Fiserv provides “financial technologies” to the financial sector. In practice, this means software for payment systems, electronic billing, mobile banking, debit and credit card processing, digital payments, debt collection, etc.

The company serves 6 million merchant locations, has 1.4 billion accounts on file, and processes 12,000 financial transactions per second, from nearly 10,000 financial institutions.

This makes Fiserv one of the original “fintech” before the word even existed. It also makes it a central part of the financial infrastructure, which gives the company a solid economic moat.

Growth might be somewhat slowing down, which is maybe not fully a surprise for such a large company. Still, the merchant segment grew revenues by 16% year-to-date and the payment and network segment grew by 11% year-to-date, showing that out of relationships with banks, the company might still be able to keep expanding.

Source: Fiserv

The company does not distribute a dividend but rewards its shareholders through a solid share repurchase program, with already $2.5B in the first two quarters of 2023.

Fiserv has been at the core of the digitalization of the financial sector. Far from a “legacy” fintech, it is also serving leading fintech companies to launch quickly and scale up, like with crypto solutions Bakkts or MoonPay, mobile banking Goalsetter, and student debt solution Candidly.

This is enabled thanks to Fiserv’s AppMarket, whose API allows to connect growing Fintech firms to thousands of financial institutions without having to reinvent the wheel.

Thanks to its historical role in digitalizing financial systems, and its keystone positions in enabling further Fintech innovation, Fiserv is likely to stay at the forefront of software advancement in the financial sector, while also expanding quickly in new markets like merchant and payments.

Autodesk, Inc. (ADSK)

Autodesk is the creator and provider of many professional 3D software programs, of which the most famous is probably AutoCAD. They are used worldwide by professionals like engineers and architects for designing industrial components, buildings, and 3D models.

Because they are often the standard practice for their industries, these softwares have a very strong economic moat, where entire professions depend on them daily and for which proficient skills at using them to their full potential can be a career-making advantage.

Autodesk is very active in staying on top of its industries’ innovations, among which is the concept of “extended reality”. This concept includes and merges together AR, VR, and “mixed reality”, treating them all in a continuum of blended digital and real experiences. These can be used to design new things, but also to share ideas and 3D models with colleagues, and include real-time collaboration on shared virtual items.

Source: Autodesk

Safely protected by its firm grasp over the industries in which it operates, Autodesk is able to leverage partnerships with almost all the key actors of VR/AR technology development, including Unity, Unreal Engine, and NVIDIA.

Source: Autodesk

Manufacturing is becoming an increasingly high-tech process, with 3D designs being produced through CNC machining, 3D printing, and other automated or robotic processes.

This puts Autodesk at the forefront of industrial innovation, and increasingly a key partner for the integration of AI into industrial designs, through “generative design”.

So while the most visible part of innovation in AI and software might be image generation and chatbots, the most impactful for the world might be in greener and more efficient machinery, robots, and buildings, all possible thanks to the integration with Autodesk software.

CrowdStrike Holdings, Inc. (CRWD)

The more software becomes important, the more cybersecurity moves from just “needed” to absolutely vital. This is especially true as most of our software usage is migrating to the cloud, driven by SaaS subscription, ERP software, and work-from-home.

CrowdStrike was founded with a cloud-first approach to cybersecurity. The company’s offer covers all categories of cybersecurity threats, and among its clients are 15 of the 20 largest US banks, 70 of the Fortune 100 companies, and 556 of the Global 2000.

The company has achieved $2.7B of annual recurring revenues (ARR) in Q1 2023, a year-to-year growth of 42%, for a free cash flow of $227M, growing at 53%.

CrowdStrike’s growth is supported by a quickly expanding total addressable market (TAM), expected to grow 13% CAGR in the next 2 years. With additional offerings still in development, the company expects to expand its TAM from the current $76B to $158B by 2026.

Source: CrowdStrike

Another growth factor for CrowdStrike is the expansion of business with pre-existing clients. When a client starts with at least one cybersecurity module, it usually goes on and keeps integrating more modules, with 62% of clients using 5 or more modules, and 23% using 7 or more modules.

This dynamic creates an environment that allows CrowdStrike to grow its margins when a relationship has developed for long enough, with an impressive total gross margin of 78% in 2023.

Source: CrowdStrike

The transition to the cloud is still mostly ongoing for many large companies. This creates a large opportunity for a market leader like CrowdStrike to help them transition their cybersecurity strategy to the cloud as well.

The company should also see its international business grow, with still 3/4th of the Global 2000 companies yet to enter the CrowdStrike ecosystem. The company’s innovation and the constant addition of new functionalities/modules also keeps it at the edge of its sector and able to respond to quickly evolving cyber threats.

The cloud-first approach of CrowdStrike has allowed it to quickly take market share and is now replicated by all the large cybersecurity companies. So investors will want to pay attention to CrowdStrike’s ability to retain its advantage despite mounting counter-attacks by the industry.

IQVIA Holdings Inc. (IQV)

While software innovation is often confined to the tech industry, other segments of the economy are themselves highly innovative and need all the available tools to handle their data.

A prime example is the biotech and pharmaceutical industry.

IQVIA provides software, database, and data analytic solutions to the life science industry. It is especially well established in the clinical trial market, with 5 million clinical trial investigators in its network, 2,000+ partner hospitals, and a 100 million patient network for trial recruitment in 100+ countries.

Source: IQVIA

This makes IQVIA a partner, at one point or another, of most drug development and medical progress. All top 15 pharmaceutical companies use IQVIA services.

Source: IQVIA

The reach of IQVIA also gives it the possibility to analyze and sell data about pharmaceutical markets, R&D spending, and overall insights & intelligence on the industry. Its analytic solution, for individual clients or industry-level, uses AI and machine learning to optimize data profiling and analytics.

A growing segment for IQVIA is also the public sector: payers, providers, and government. It can help them analyze and better leverage their available data, helping them to optimize costs, make better decisions, and overall improve healthcare.

In the post-pandemic landscape, IQVIA has suffered from slightly declining/plateauing revenues and earnings after the boom in activities in 2021. The company income is driven by R&D solutions, followed closely by technology and analytic solutions.

IQVIA is an integral part of the R&D ecosystem in life science and pharmaceuticals. With biotech reaching the point of many new concepts and technologies now ready to enter the clinical trial stage, it is expected that the sector will keep growing for the foreseeable future, at least in the long term.

It will also increasingly need more medical data and advanced analytical methods using AI, and rely on IQVIA’s offer for an AI-driven patient journey, analyzing clinical trials results with AI, and decreasing many risks.

Source: IQVIA

So investors in the company will directly benefit from the emergence of innovative treatments like gene therapies, cell therapies, mRNA, etc. as well as the need for dedicated AI tools for the healthcare sector.

Palantir Technologies Inc. (PLTR)

Palantir is a somewhat secretive intelligence company founded by PayPal cofounder Peter Thiel. Its offer is to be “Powering AI-assisted decision making — from war zones to factory floors.”

The company claims to be at the forefront of a new arms race, fought in the field of developing AI weapons, between democracies and autocracies.

Palantir is also active in optimizing industrial operations, from Cisco to Panasonic or Novartis.

Still, it seems a lot of the company business is with the US government and the military-industrial complex, notably in May 2023 with a $463M contract for an AI-enabled mission command platform with the US Special Operation Command (SOCOM).

The company has grown its revenues more than 3x since 2019 and had for the first time a profitable period in H1 2023, with a net profit of $14M. And $285M of free cash flow in H1 2023.

Source: Palantir

The company maintains an impressive 80-82% gross margin as well. In Q2 2023, it had a cash stash of $3.1B (10% of total market cap) and no debt.

The actual product delivered by Palantir is a little hard to grasp, due to the rather confidential and sensitive nature of most of the details of its AI-powered services. So investors are forced to judge it from the assessments of Palantir’s clients, including the US government and many major international corporations.

From this perspective, it seems that Palantir technology is very impressive, and quickly becoming a central part of the decision-making and problem-solving of the Western economy and governments.

With the AI mania going on, it seems that Palantir is one rare AI company with already proven use cases and technology applied to real-world needs. This should give Palantir a large space for growth, especially as the geopolitical situation of the world seems to get less stable by the day.

Unity Software Inc. (U)

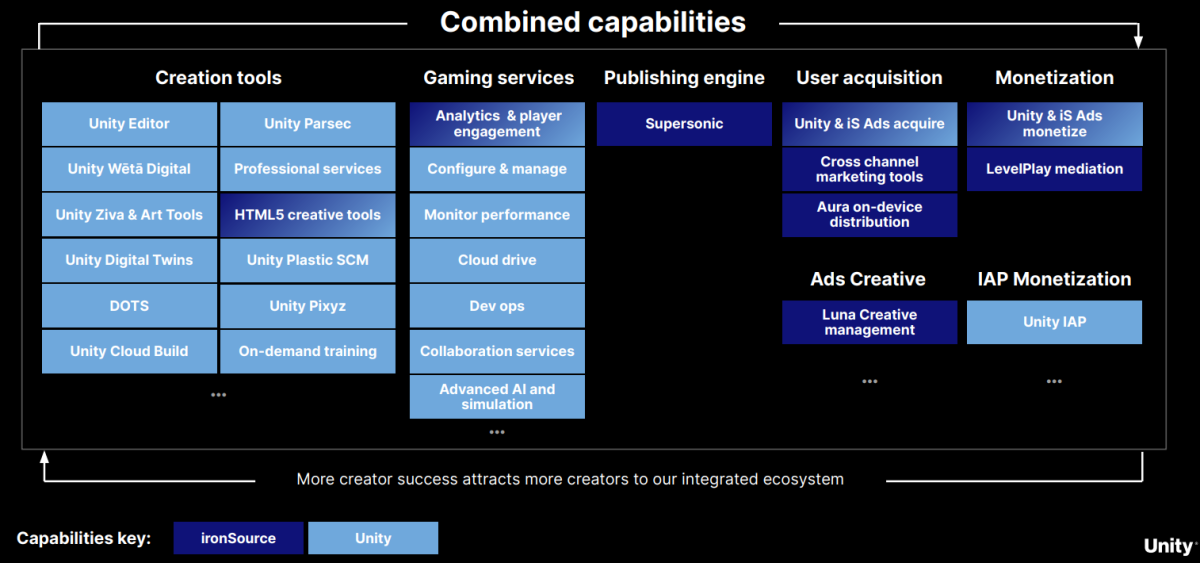

Unity’s core business is a 3D engine used by video game developers all over the world. It is one of the most popular engines, together with the Unreal engine, indirectly owned by Tencent. The engine also provides a very extensive asset shop, providing for a few tens of hundred dollars in digital assets what would cost hundreds of hours of work to recreate from scratch.

Source: Unity

To add to its videogame offer, Unity acquired IronSource, an analytics, monetization, and marketing platform, making it a one-stop shop for developing AND selling a videogame.

Source: Unity

This videogame focus has since the early days expanded to all 3D modelization, including in industries like automotive (Mercedes Benz) defense (CACI) or construction (Obayashi). Revenues outside of the game accounted for 40% of Unity revenues in Q2 2023.

Another segment of growth for Unity is filmmaking. With the purchase of Weta Workshop in 2021, famous for the CGI and FX for the Lord of The Ring trilogy, Unity is now able to use its digital asset database to blend the difference between movie and videogame making, like for the water effects of Avatar 2.

The company revenues were down in 2022, with a low of $297M in Q2 2022, bouncing back to $533M in Q2 2023. Still, the company is operating at a loss, mostly due to a massive $267M in R&D.

Every segment where Unity is a dominant force is poised for strong growth. Videogames are now the most popular and highest-revenue entertainment sector, with AR/VR offers only beginning to reach the market.

Movies are increasingly reliant on CGI, with filming in front of a green screen may have been just the first step before AI-simulated actors.

And many industries are now embracing 3D printing, VR, and 3D modeling for designing new components, interfaces, and products.

This makes Unity a strong “pick and shovel” stock for anything related to 3D models, AR/VR, 3D printing, and digital simulation. No matter which VR headset or game & movie IP succeeds, Unity is likely to have been instrumental in making it happen.

The massive R&D spending is hurting the company’s profitability, but also helping it grow its offer further. So this is a stock for patient investors willing to wait for Unity to reach the critical mass where it can turn profitable and/or reduce its R&D costs.

The post Best 10 Software Stocks for Technological Advancements appeared first on Securities.io.