Decentralized Finance (DeFi) has been an interesting experiment in finance to see if smart contracts could replace banks. However, DeFi’s inconsistent revenues could become a hurdle to it being massively adopted as traditional investors prefer steadily rising incomes for growth assets like tech stocks.

DeFi Pulse Index (DPI) dropped by 57.3% Over Last Three Months

Following the announcement of interest rate hikes in late November, the S&P 500 declined by 8.4% in the last three months. During the same period, Bitcoin went down by 31.9%, pulling altcoins down with it.

The retreat also included DeFi tokens. To quantify the pullback, we can take a look at DeFi’s equivalent to the S&P 500, the DeFi Pulse Index (DPI).

Accounting for the weighted performance of all the major DeFi tokens from Aave, Uniswap, Maker, Compound, Sushi, Balancer, and others, DPI has fallen by 57.3% in that same 3-month period, from $361 to $154. That is to say, DeFi tokens performed nearly 7x times worse than S&P 500 and nearly twice as bad as Bitcoin.

Likewise, across all blockchain networks, the DeFi market lost 21.8% of its total value locked (TVL), from December 1’s peak at $254.99 billion to the present $199.31 billion. Interestingly, if we isolate only Ethereum-based DeFi protocols, the drop was even more significant, at 28.3%, from $162.8 billion to $116.63 billion during the same period.

DeFi Offers Innovation but Lacks Consistent Growth Expected by TradFi

If we turn the clock back to the last two years, during which DeFi’s total value locked (TVL) went from $1 billion to over $100 billion, it was not uncommon to compare the emerging market to the 2017 ICO bubble. Early adopters made a killing by pumping and dumping new DeFi tokens, accompanied by occasional code exploits and hacks.

However, the utility of the unbanked finance proved too appealing in the end, and DeFi proved detractors wrong. Furthermore, it was not completely reasonable to expect that an experimental smart contract technology would work flawlessly from the get-go. While the S&P 500 had 65 years to track real-world assets represented by publicly traded companies, the DeFi Pulse Index had less than a year to do the same.

Moreover, because DeFi is essentially software aimed at efficiency, it relies on investors to turn away from traditional finance. This poses a problem for DeFi because such investors value immediate growth over the future potential of blockchain technology.

Join our Telegram group and never miss a breaking digital asset story.

DeFi Token’s Equivalent to the PE Ratio

In traditional finance, price to earnings ratio (P/E) tells us if the company is considered over or undervalued. Generally speaking, if P/E is high, investors count on future growth, so they don’t necessarily mind that the price of an asset is much higher than earnings. In DeFi, we see the same dynamic with the market cap to TVL ratio.

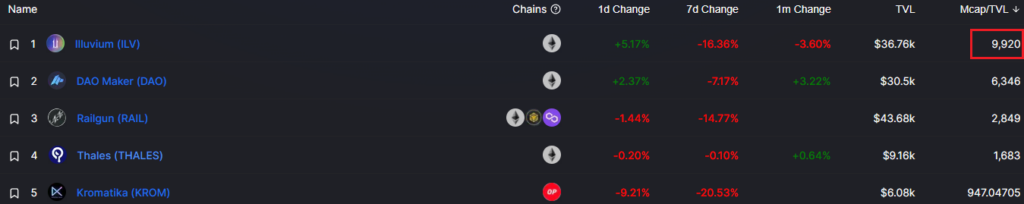

Case in point, the upcoming triple-A blockchain game Illuvium hasn’t yet been released. Meaning, it has no earnings to show for it. Yet, it tops the chart when it comes to its market cap to TVL ratio.

In contrast, the top 10 DeFi protocols all have mcap/TVL ratios well under 1, signifying major undervaluation.

To illustrate further, Aave, one of the bigger DeFi protocols, trades at 90x P/E. Having recently announced the Lens Protocol to redefine social media, its revenue reached the peak last November at $52.65 million and then dropped to $33 million in January in just a few months, which is a 37% decrease. If one were to look at Aave from a growth investor’s perspective, the inconsistent earnings could seem like a red flag.

So, these data points are not at all encouraging for traditional investors looking for growth assets like tech stocks. That is if they would even broach DeFi tokens now that the SEC has made an example out of more centralized BlockFi that provides the same service. If the same KYC/registration requirements are placed on DeFi protocols, they may as well leave the US investors behind.

On the other hand, Canada’s heavy-handed approach in freezing bank accounts is the best global marketing campaign DeFi ever had. Jeff Dorman, the chief investment officer at Arca, seems to think DeFi tokens will emerge even stronger, owing to their innate, smart-contract-based transparency.

Blockfi has been running an unregistered hedge fund for years with zero disclosures to depositors in terms of what they do to generate yield.

DeFi lenders are 100% transparent with regard to how it works and where yield comes from.

You may be right, but not apples to apples

— Jeff Dorman, CFA (@jdorman81) February 12, 2022

In the meantime, other countries continue to mainstream DeFi exposure.

Switzerland-Based Index Offers Top DeFi Tokens

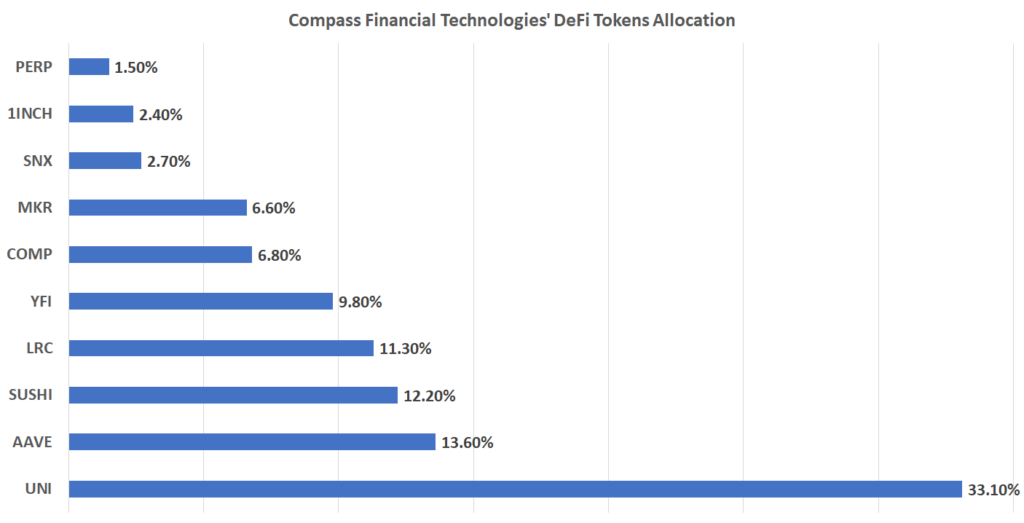

Based in Switzerland, Compass Financial Technologies is holding $5 billion AuM across EU’s exchange-traded products (ETPs). As of yesterday, the index provider announced it will add 10 DeFi tokens into the mix, with the following allocation.

Accelerated DeFi in Europe is not that surprising. Notably, the EU plans to invest €750 billion euros in crypto technologies. Compass prepared for this initiative by partnering with CoinShares in June 2020.

Together, they launched the CoinShares Gold and Cryptoassets Index (CGCI), as the first EU-compliant index that employs volatility harvesting. Meaning, it uses gold as a rebalancing mechanism for crypto assets.

In comparison, the US Congress has yet to deliver baseline clarification on digital assets, counting on the SEC to interpret pre-WWII securities laws instead.

Do you think the simple action of holding Bitcoin, in the hopes it appreciates, is more enticing than dabbling in DeFi protocols, despite bigger yields? Let us know in the comments below.

The post Why TradFi Would Not Be Interested in a DeFi Index Fund appeared first on The Tokenist.