Following the initial surge of $100 million worth in crypto donations, the Ukrainian central bank put a damper on the trailblazing funds gathering. Last Thursday, the National Bank of Ukraine imposed a monthly limit on crypto transactions at UAH 100,000 ($3,300).

Ukraine Puts Halt on Buying Crypto with Hryvnia

Moreover, Ukrainians would have to purchase cryptocurrencies with foreign fiat money. Predictably, this created a drop in Ukrainian crypto trading. In fact, according to the latest Kaiko Research report released today, the volume dropped to the pre-invasion level.

Interestingly, even before the invasion, Ukraine traded more in crypto assets than in fiat currency. This is not that surprising given the fact that Ukraine is neck and neck with Russia as a top crypto adopter. According to last year’s triple-A report, Ukraine ranked first at 12.73% of the population holding cryptos, with Russia trailing closely behind at 11.91%.

Undoubtedly, that percentage increased after the Ukrainian parliament passed a crypto regulation bill on February 18th, a week before the Russian invasion. Although the beleaguered nation did not make Bitcoin equal to legal tender like El Salvador, the law did drag blockchain assets outside of the uncertainty zone.

“Market participants will receive legal protection and the opportunity to make decisions based on open consultations with government agencies,”

Mykhailo Fedorov’s statement as Ukraine’s Minister of Digital Transformation

In the meantime, Ukraine became the first nation to provide crypto wallet addresses from official government accounts. The question then is, why the sudden U-turn from a progressive stance on digital assets?

Join our Telegram group and never miss a breaking digital asset story.

Why Did Ukraine Limit Crypto Payments?

Contrary to initial reports that Ukraine “banned Bitcoin”, the National Bank of Ukraine (NBU) issued a temporary limit on “quasi cash transactions”.

“…the quasi cash transactions include the replenishment of e-wallets and brokerage or forex accounts, the cashing of traveler’s checks, purchases of virtual assets, and more.”

As mentioned, this limit is $3,300 per month. The big clue why it was instituted lies in the condition that, even under that limit, digital assets must be purchased with foreign currency instead of the Ukrainian national currency, the hryvnia.

As a nation that is already territorially sectioned off, it is vital for it to keep its economy afloat. Case in point, since the conflict started, NBU recorded an outflow of $1.7 billion from Ukrainian banks in March and $900 million in April. To continue its international obligations and relieve the pressure on the forex market, NBU deems “quasi cash” transactions as “nonproductive capital outflow” under martial law.

“…payment cards are also used to pay for quasi cash transactions largely made to circumvent the existing NBU restrictions, including for foreign investment purposes, which is prohibited under martial law.”

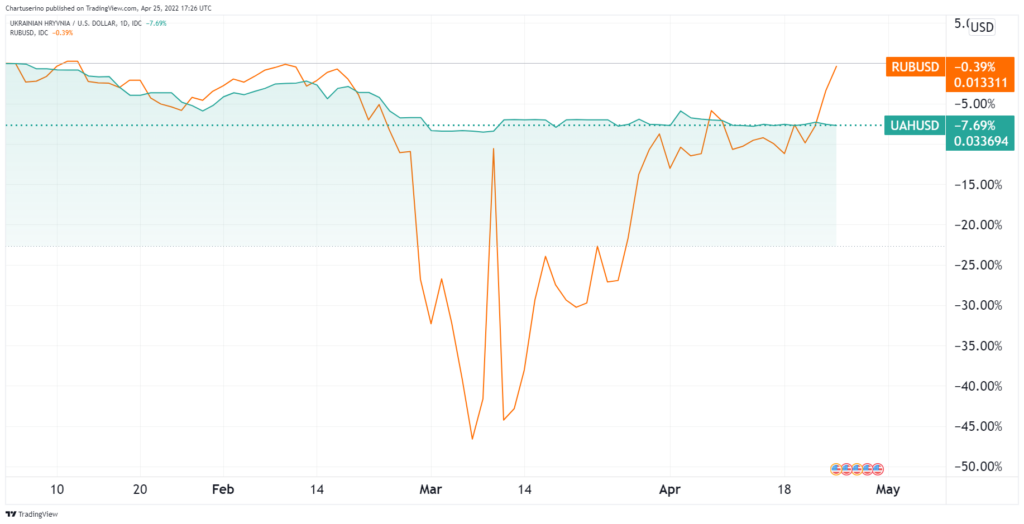

The same dynamic of bolstering national currency applies to Russia as well. For example, the Credit Derivatives Determinations Committee (CDDC) ruled Russian Railways JSC as a “failure to pay” event. Not because Russia couldn’t pay, but because it paid in rubles.

By forcing Russia to pay in non-national currency, the international body effectively suppressed the ruble’s ability to recover even faster than it already did.

In the end, just like with any asset, fiat money’s value relies on supply and demand. Not only has Russia more than doubled its gold reserves since 2014 to bolster the ruble, but its massive energy exports can count on India and China regardless of sanctions.

By the same token, NBU limited crypto transactions to foreign accounts in order to make hryvnia available for international settlements and payment systems. For this reason, the limit should not be viewed as a negative trend for crypto, but as a necessary pressure release valve for a country at war.

Given that the average Ukrainian wage is just under $500, do you think a $3,300 monthly limit would only affect the wealthier citizens? Let us know in the comments below.

The post Trading Volume Dwindles in Ukraine After Ban on Buying Crypto with Local Currency appeared first on The Tokenist.