Pondering an STO SBI Holdings has recently released a financial report, detailing the health of their various business ventures. In this report, it was announced that after experiencing a successful first year in the world of cryptocurrencies, they are intending on hosting an upcoming STO in 2019. While they intend to host an STO this […]

Tag: STO

Leading Japanese Law Firm Nagashima Ohno & Tsunematsu Provides Commentary on the New Payment Services Act for Cryptocurrencies

On March 15th 2019, a bill was submitted to the 198th session of the Diet to amend the Payment Services Act. The proposed bill would clarify digital securities in Japan. A bill is being considered in the Diet which could have serious ramifications for security token offerings in Japan. Currently the Payment Services Act (PSA) […]

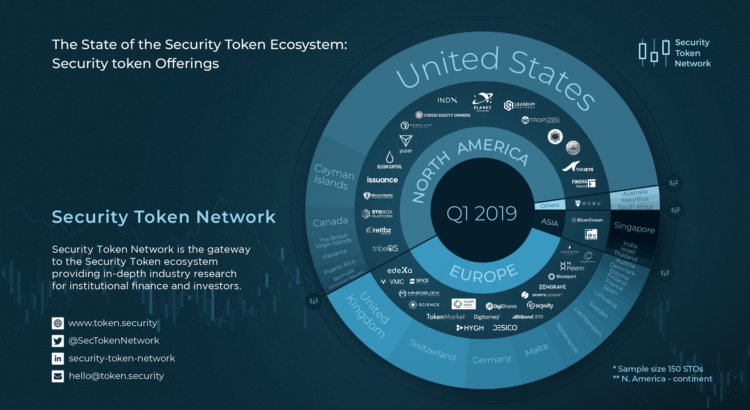

The Security Token Ecosystem – STOs Q1 2019

The State of the Security Token Ecosystem. We sampled 150 STOs and you can see their distribution in the outer circle. The article The Security Token Ecosystem – STOs Q1 2019 was first published on Security Token Network.

Polymath’s Chief Product Officer Says That Security Tokens Are Even Better Than You Think

Utility tokens versus security tokens: what’s the difference? According to Polymath’s Chief Product Officer, the future lies with security tokens because they make the most sense as a financial instrument. Tokenizing equity is one idea commonly applied to security tokens, but for Polymath’s Chief Product Officer Thomas Borrel, this is just the tip of the […]

The Security Token Ecosystem – Q1 2019 – Exchanges, STOs, Issuance, Funds & Agencies

Key players, movers and shakers, across the security token ecosystem in this infographic from security token network. The article The Security Token Ecosystem – Q1 2019 – Exchanges, STOs, Issuance, Funds & Agencies was first published on Security Token Network.

FINRA Grants ATS Licensure to SeedInvest

ATS Licence Granted News came today, from Circle and subsidiary SeedInvest, that the latter has successfully applied for, and been granted, an ATS license. This approval took place through FINRA – a United States regulatory body, which oversees the actions of broker/dealers. This approval grants SeedInvest the ability to form a secondary market in which […]

Nexo Partners with Securitize to Launch Credit Lines Backed by Digital Securities

As of April 22nd 2019, Nexo has partnered with Securitize to offer instant credit lines backed by digital security assets. The partnership will utilize the Securitize’s Digital Securities (DS) Protocol. Nexo’s Digital Securities-backed Credit Lines Explained Nexo is a crypto lender that grants credit lines to clients in exchange for digital assets. Typically, users deposit […]

US Capital Global to Utilize Services by Vertalo

Cap Table Adoption It was recently announced that Vertalo and US Global Capital have partnered together. This partnership was established with the goals of increased adoption (Vertalo) and increased versatility (US Global Capital). Recognizing the benefits that Vertalo’s complementary services could offer them, US Global Capital will now have the ability to offer these services […]

Nexo to Offer Digital Security backed Credit-Lines

Credit Lines and Digital Securities In a recent announcement, Nexo and Securitize have stated the formation of a new partnership. This entails Nexo incorporating the DS-Protocol into their services. The DS-Protocol refers to Securitize’s solution for a lifecycle management of digital securities. By incorporating this into their platform, Nexo gains the ability to offer collateralized […]

Security Token Roundtable – Institutional Adoption Webinar with Investment Bank BTG Pactual

Hosted by Liqua, Security Token Network, and DL Capital Partners, we go behind the scenes with leading investment bank BTG Pactual and their STO. The article Security Token Roundtable – Institutional Adoption Webinar with Investment Bank BTG Pactual was first published on Security Token Network.