- Over $9o,000 traders were liquidated in 24 hours as Ethereum, Bitcoin prices surged to $3,800 and $71k respectively.

- Total liquidations reached $383 million, with $297 million in shorts and $86 million on longs.

- Market is upbeat about SEC approving spot Ether ETF after latest developments the regulator initiated late Monday.

Coinglass data shows that more than 90,000 traders were liquidated in the past 24-hours, with total liquidations reaching $383 million.

The spike in prices for Ethereum, Bitcoin, Dogecoin and other tokens saw over $297 million in short positions liquidated. Longs accounted for about $86 million in liquidated positions as crypto prices skyrocketed late Monday and on Tuesday.

According to Coinglass, the total number of liquidated traders reached 93,833 at 11:40 am ET on Tuesday. The largest liquidation happened on BitMEX, with an XBTUSD trade worth $4.26 million liquidated.

Ethereum traders see over $100 million in short liquidations

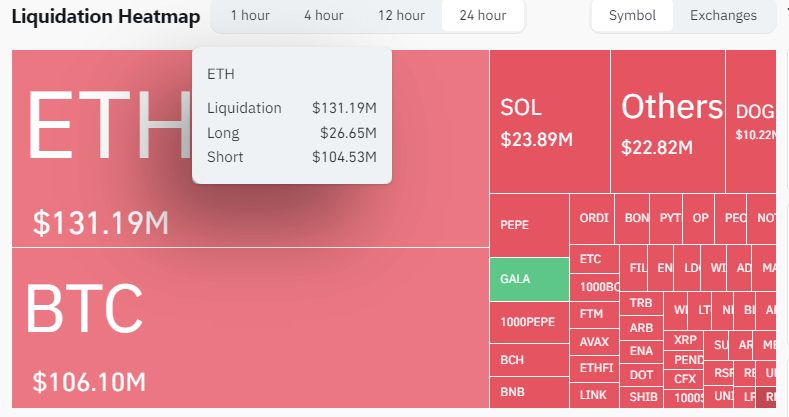

Ethereum (ETH) led the 24-hour liquidation as the top altcoin’s spike to above $3,813 on May 21 saw over $131 million rekt. This included a total of $104.5 million in shorts and $26.5 million in longs.

As well as Ethereum, Bitcoin (BTC) also recorded a significant spike in its price.

The benchmark crypto jumped from lows of $67k on Monday to hit highs of $71,650 on Tuesday. The gains led to the liquidation of positions worth over $106 million, including $88 million in shorts and $18 million in longs.

Solana (SOL) saw a total of nearly $24 million, with shorts accounting for over $17.9 million and longs $5.9 million.

Other tokens to see notable liquidations in the past 24 hours are Dogecoin (DOGE) with $10.2 million, Pepe (PEPE) with $7 million and Gala (GALA), which suffered a major security breach on Monday.

Over $2.69 million short positions and $2.1 million worth of longs have been liquidated in the past 24 hours, although Gala has received a bullish forecast from market maker DWF Labs, which announced the purchase of 25 million GALA tokens.

SEC’s potential approval of spot Ether ETF boosts bulls

The huge liquidations come as fresh sentiment around spot Ethereum ETFs approval lifted the crypto market.

This followed SEC’s request for Ether ETF issuers to file their 19b-4s by 10 am on May 21, a development that has seen Bloomberg ETF analysts increase their odds for a SEC approval from 25% to 75%.

Standard Chartered Bank’s Geoff Kendrick said in a note on Tuesday that there’s a possibility of the SEC greenlighting the first spot Ethereum ETF for the US market this week.

Standard Chartered also predicts that ETH price could spike to $8,000 by the end of the year.

In March, analysts at the bank projected Bitcoin could surge to $15ok in 2024 and $250k by end of 2025 on the back of ETF traction.

The post Over 90K traders liquidated amid massive crypto price surge appeared first on CoinJournal.