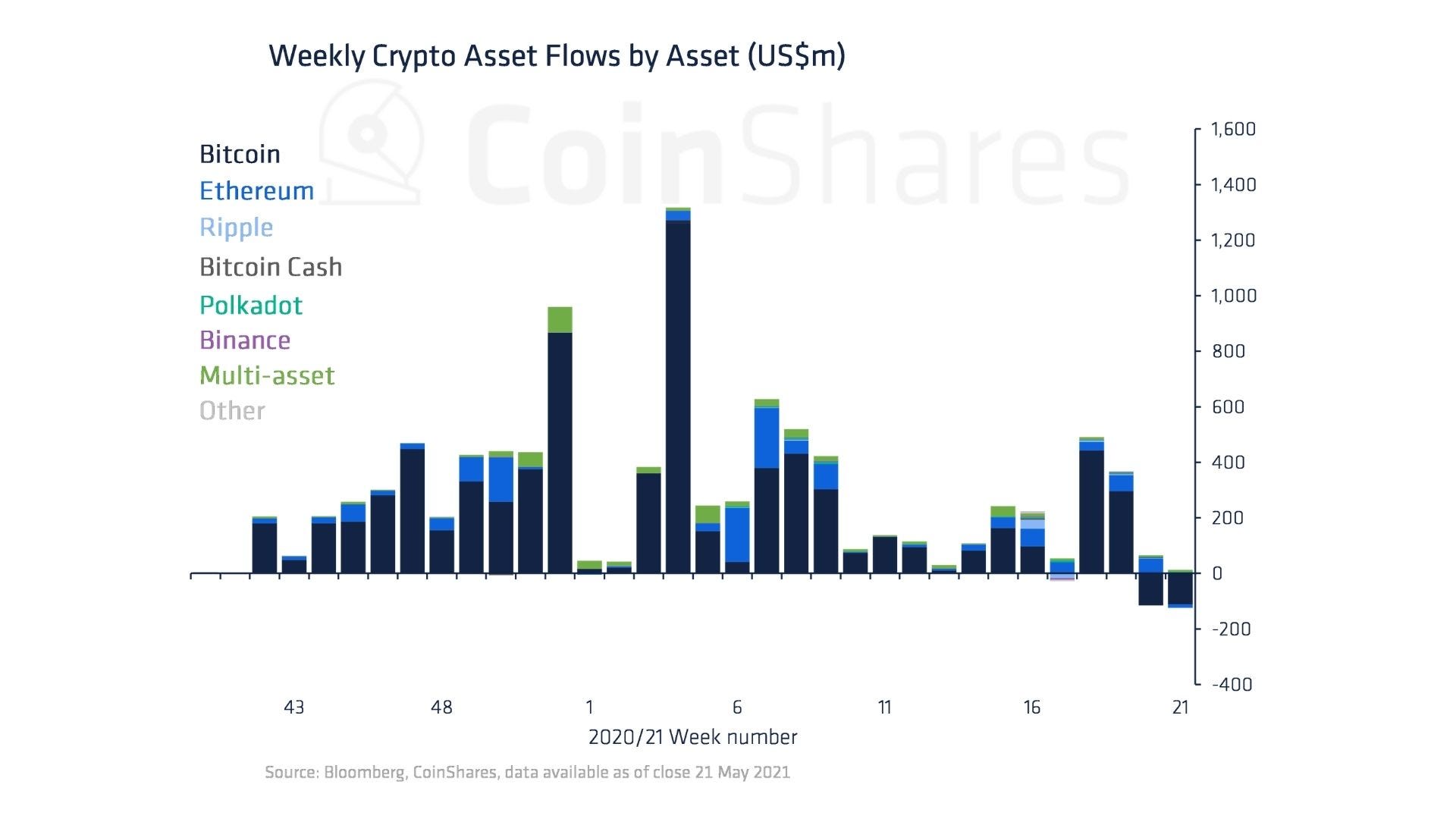

Digital asset investment products saw yet another record outflow for the second consecutive week.

For the week ending May 21, 2021, another new record of outflows totaling $97 million occurred, representing only 0.2% of total assets under management (AUM).

Compared to net inflows for the year to date, $5.5 billion, the outflows remain low at 11.8% of AUM. Still, it represents “a net change in sentiment following increasing regulatory scrutiny and concerns over Bitcoin’s environmental credentials,” reads the weekly report from CoinShares.

The outflows for Bitcoin (BTC) were, in fact, lower at $111 million last week versus $115 million the previous week.

BTC 0.54%

Bitcoin / USD

BTCUSD

$ 38,101.02

$205.75

0.54%

Volume 59.79 b

Change $205.75

Open $38,101.02

Circulating 18.72 m

Market Cap 713.19 b

33 min

White House Studying ‘Gaps’ in Cryptocurrency Market Oversight: Report

1 h

One River Asset Management Submits Proposal to SEC for Carbon-Neutral Bitcoin ETF

1 h

Marathon & Compute North Partner to Achieve 10.37 EH/s Hash Rate; Miners Will Be 70% Carbon Neutral

What added to the total record outflows was Ethereum (ETH) which saw minor outflows of $12.6 million following its long run of record-breaking inflows totaling $924 million year to date, which is 8% of AUM.

ETH 1.68%

Ethereum / USD

ETHUSD

$ 2,607.30

$43.80

1.68%

Volume 50.77 b

Change $43.80

Open $2,607.30

Circulating 116.02 m

Market Cap 302.5 b

33 min

White House Studying ‘Gaps’ in Cryptocurrency Market Oversight: Report

1 h

One River Asset Management Submits Proposal to SEC for Carbon-Neutral Bitcoin ETF

2 h

Augur Launches Sports Betting Platform, Turbo, Built on Polygon Using Chainlink’s Oracles

Source: CoinShares

Interestingly, altcoins registered a continued positive sentiment with inflows across the board totaling $27 million. Cardano (ADA) remains the most popular, which had the largest inflows of $10 million, “which may represent investors actively choosing proof of stake coins based on environmental considerations.”

ADA 3.53%

Cardano / USD

ADAUSD

$ 1.55

$0.05

3.53%

Volume 6.45 b

Change $0.05

Open $1.55

Circulating 31.95 b

Market Cap 49.66 b

2 h

Crypto Asset Funds had Record Outflow for Second Week in a Row; Cardano Attracted its Largest Inflow

1 d

Is The Worst Over? This Is What The Bears And Bulls Have To Say

3 d

Cryptocurrency Exchange ShapeShift Reveals Gas Fee Mitigation Functionality With FOX Token Rewards

Multi-asset and Polkadot (DOT) investment products also saw inflows of $7 million and $5.5 million, respectively. While BNB didn’t have any inflows, Litecoin (LTC), Stellar (XLM), and Ripple (XRP) did see some at $1.8 million, $1.1 million, and $900k, respectively.

DOT -2.84%

Polkadot / USD

DOTUSD

$ 21.65

-$0.61

-2.84%

Volume 3.51 b

Change -$0.61

Open $21.65

Circulating 941.89 m

Market Cap 20.39 b

2 h

Crypto Asset Funds had Record Outflow for Second Week in a Row; Cardano Attracted its Largest Inflow

1 d

Polkadot Not Producing Blocks, Network Validators Asked to Downgrade Nodes

1 d

PwC Report: Boom Time For DeFi Sector As Crypto Hedge Funds Show Growing Interest

BNB 3.44%

Binance Coin / USD

BNBUSD

$ 335.05

$11.53

3.44%

Volume 6.13 b

Change $11.53

Open $335.05

Circulating 153.43 m

Market Cap 51.41 b

2 h

Crypto Asset Funds had Record Outflow for Second Week in a Row; Cardano Attracted its Largest Inflow

1 d

Is The Worst Over? This Is What The Bears And Bulls Have To Say

5 d

BSC-based BUNNY Crashes 95.5% Following a Flashloan-based Price Manipulation Attack

LTC 3.35%

Litecoin / USD

LTCUSD

$ 176.27

$5.91

3.35%

Volume 5.44 b

Change $5.91

Open $176.27

Circulating 66.75 m

Market Cap 11.77 b

2 h

Crypto Asset Funds had Record Outflow for Second Week in a Row; Cardano Attracted its Largest Inflow

4 h

Bitcoin Miners & Elon Musk Meet Behind Closed Doors to Promote Energy Usage Transparency & “Pursue ESG Goals”

1 d

PwC Report: Boom Time For DeFi Sector As Crypto Hedge Funds Show Growing Interest

XLM 0.20%

Stellar / USD

XLMUSD

$ 0.43

$0.00

0.20%

Volume 2.1 b

Change $0.00

Open $0.43

Circulating 23.12 b

Market Cap 9.83 b

2 h

Crypto Asset Funds had Record Outflow for Second Week in a Row; Cardano Attracted its Largest Inflow

1 w

Samsung Updates Galaxy Smartphones With New Support for Crypto Hardware Wallets

2 w

Tech Stocks Dragging Bitcoin, Ether, & Crypto’s Down, But ‘Fundamentals Still Strong’

XRP 8.61%

XRP / USD

XRPUSD

$ 0.95

$0.08

8.61%

Volume 9.17 b

Change $0.08

Open $0.95

Circulating 46.14 b

Market Cap 43.81 b

2 h

Crypto Asset Funds had Record Outflow for Second Week in a Row; Cardano Attracted its Largest Inflow

3 h

Ripple Developers Plan to Add Support For NFTs on the XRP Ledger (XRPL)

1 d

Is The Worst Over? This Is What The Bears And Bulls Have To Say

While 21Shares, Grayscale, and 3iQ recorded some inflows, ETC issuance, Purpose, and CoinShares had net outflows.

“Opportunity for Growth”

On Monday, digital asset manager CoinShares also announced a record-setting 2021 with its earnings, including the changes in the value of its digital assets quadrupling in the first quarter to £32.1 million ($45.4 million).

Despite the crypto market reaching as high as $2.6 trillion market cap at one point, these “impressive” numbers “only comprises 35 basis points of global wealth, highlighting the opportunity for growth,” said Jean-Marie Mognetti, CEO of CoinShares.

The company which trades on the Nasdaq also reported a £24.7 million ($34.9 million) year-on-year increase in comprehensive income. Its assets under management also grew about 10-fold to £3.4 billion ($4.8 billion).

Compared with a net income of £80 million ($113 million) the prior year, the company reported a first-quarter loss of £1.77 billion ($2.5 billion).

CoinShares also announced that it intends to launch a business segment for the consumer finance market to broaden its client base beyond institutional investors.

The post Crypto Asset Funds had Record Outflow for Second Week in a Row; Cardano Attracted its Largest Inflow first appeared on BitcoinExchangeGuide.